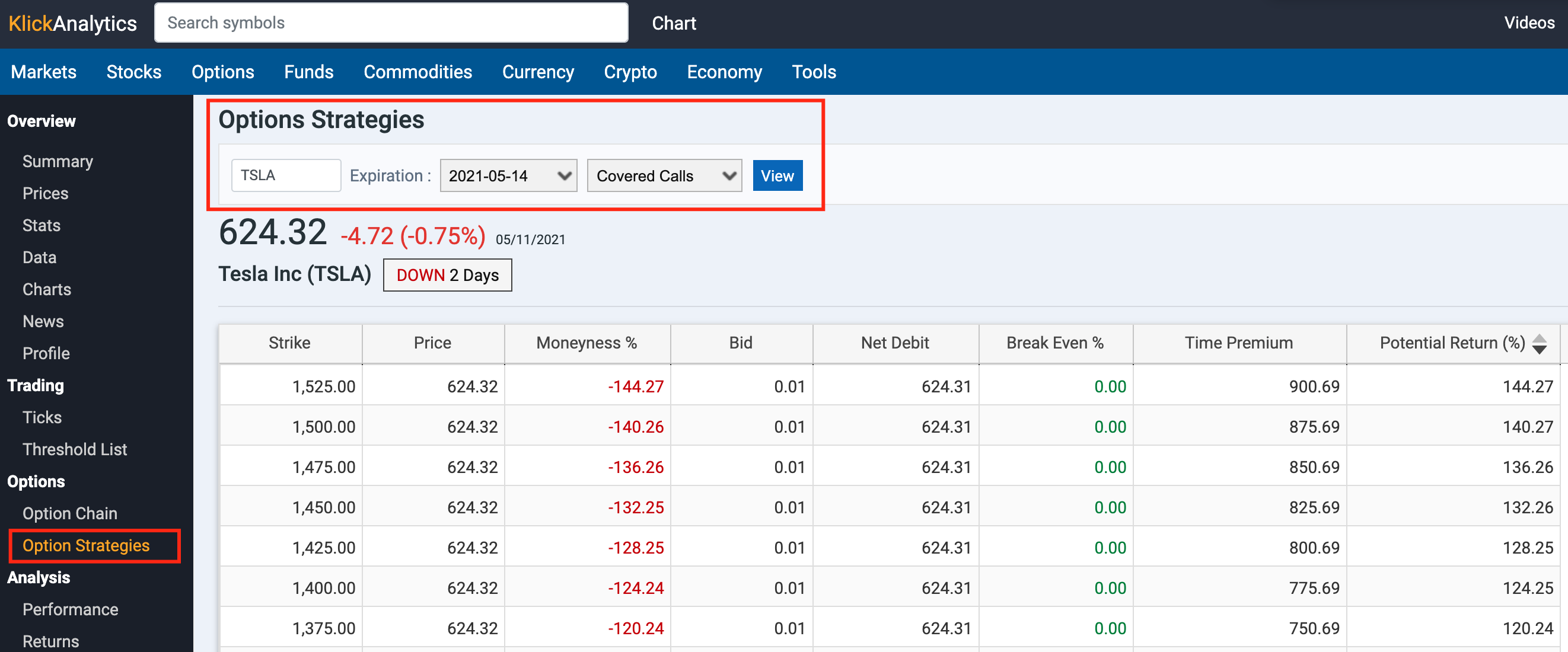

To view all possible options strategies payouts for a given company, we've added a new app called Options Strategies. The app will provide various options strategies e.g.

Covered Calls

The Covered Calls strategy page allows you to view these options for the nearest expiration date.

What is a covered call?

Selling covered calls is an investment strategy that can be used to generate additional income from the stock positions you already own. Over 75% of options are held until expiration and expire worthless. Using a covered call strategy, you can sell options on the stocks you own (providing downside protection on the stock), and earn the premium income if the option expires worthless. You earn a premium (income) from writing the call, and still have all the benefits of owning the stock (dividends), provided the call is not exercised before it expires.

Covered Calls Strategy:

The page is initially sorted by descending "Potential Return". Data fields displayed include:

Strike - the price at which the underlying security can be bought if the option is exercised.

Price - the delayed stock price at the time the strategy is updated for the underlying equity.

Moneyness - the percent from the last price: (strike price - last / last). Moneyness refers to the relative position of the underlying asset's last price to the strike price. When a call option's Moneyness is negative, the underlying last price is less than the strike price; when positive, the underlying last price is greater than the strike price.

Bid - the premium to purchase this call option.

Net Debit - the cost to enter this covered call, or the Break Even point for the call on expiration date. Net Debit (Break Even) is calculated as (Stock Price - Bid). If the stock price is HIGHER than the call's Net Debit on expiration, the call will make a profit.

Break Even% - the percentage of downside protection a covered call offers. Break Even% is calculated as ( (bid / (stock price - bid)) * 100.0 ). The greater the Break Even%, the more room you have to allow the stock to drop before expiration day and still earn a profit on the call.

Volume - the total number of options traded in the current day for a contract.

Open Interest - the total number of open option contracts in the market for a particular contract. The more popular the contract is with options traders, the greater the Open Interest. An opening transaction will increase the Open Interest, and a closing transaction will decrease it.

Delta - Delta measures the amount an option price will change as a result of a $1.00 price change of the underlying security. Since call options rise and fall directly with the price of the stock, they are assigned deltas between 0 to 100.

Implied Volatility - Implied Volatility (IV) is the estimated volatility of the underlying stock over the period of the option. IV can help traders determine if options are fairly valued, undervalued, or overvalued. It can therefore help traders make decisions about option pricing, and whether it is a good time to buy or sell options. Implied volatility is determined mathematically by using current option prices in a formula that also includes Standard Volatility (which is based on historical data). The resulting number helps traders determine whether the premium of an option is "fair" or not. It is also a measure of investors' predictions about future volatility of the underlying stock.

Potential Return - the potential return for this strategy, assuming the options are assigned or called. For a covered call, Potential Return is calculated using Time Premium, your profit (income) per share between now and option expiration.

Time Premium = (Strike + Call Bid - Stock Last Price)

Calculate Net Debit: (Stock Last Price - Call Bid)

Potential Return = Time Premium / Net Debit

To access: Search for any symbol, and then from the left symbol menu, select Options Strategies