The dividend yield, expressed as a percentage, is a financial ratio (dividend/price) that shows how much a company pays out in dividends each year relative to its stock price.

The dividend yield–displayed as a percentage–is the amount of money a company pays shareholders for owning a share of its stock divided by its current stock price.

Mature companies are the most likely to pay dividends.

Companies in the utility and consumer staple industries often having higher dividend yields.

Real estate investment trusts (REITs), master limited partnerships (MLPs), and business development companies (BDCs) pay higher than average dividends; however, the dividends from these companies are taxed at a higher rate.

It's important for investors to keep in mind that higher dividend yields do not always indicate attractive investment opportunities because the dividend yield of a stock may be elevated as the result of a declining stock price.

The dividend yield is an estimate of the dividend-only return of a stock investment. Assuming the dividend is not raised or lowered, the yield will rise when the price of the stock falls. And conversely, it will fall when the price of the stock rises. Because dividend yields change relative to the stock price, it can often look unusually high for stocks that are falling in value quickly.

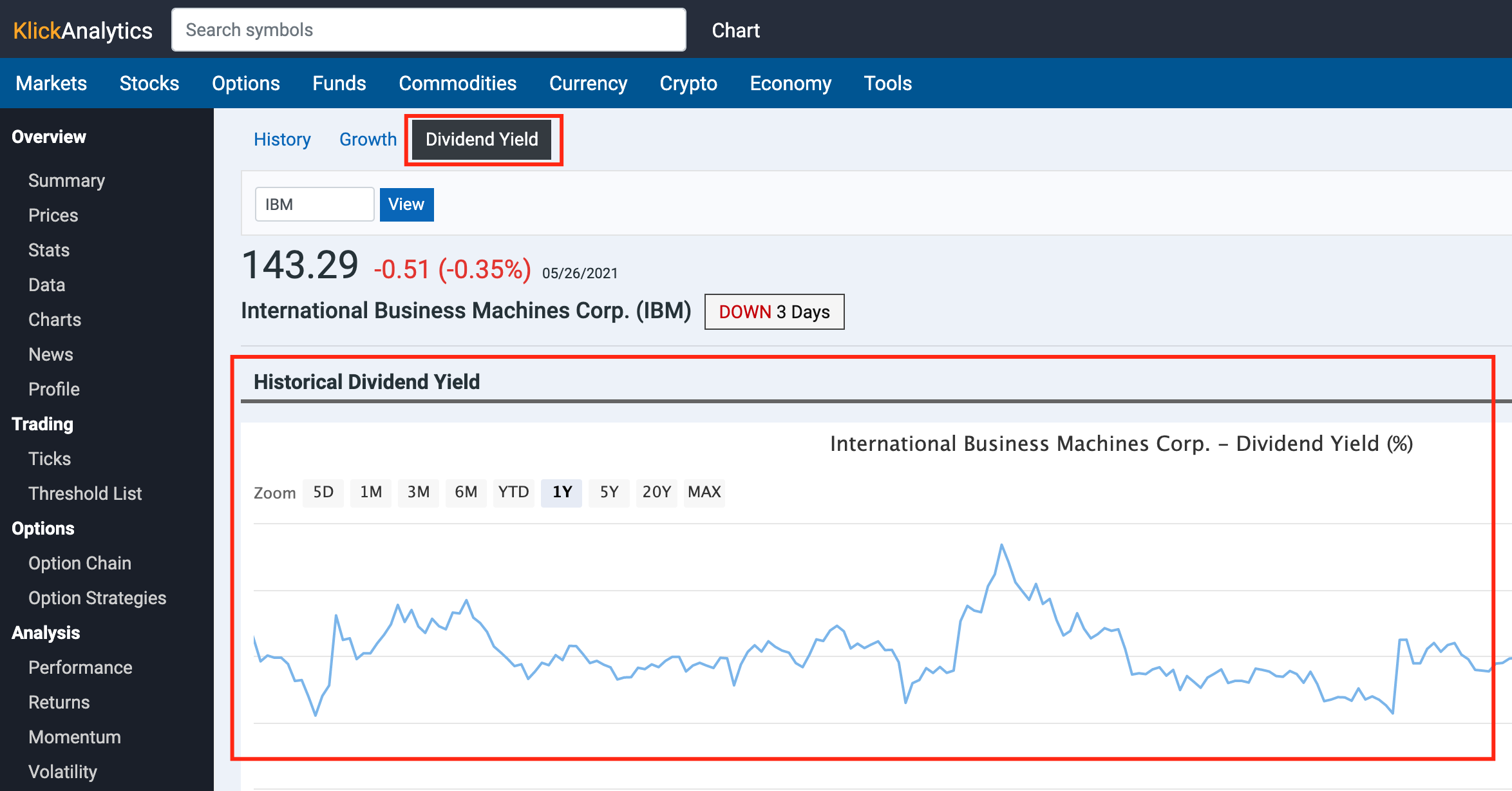

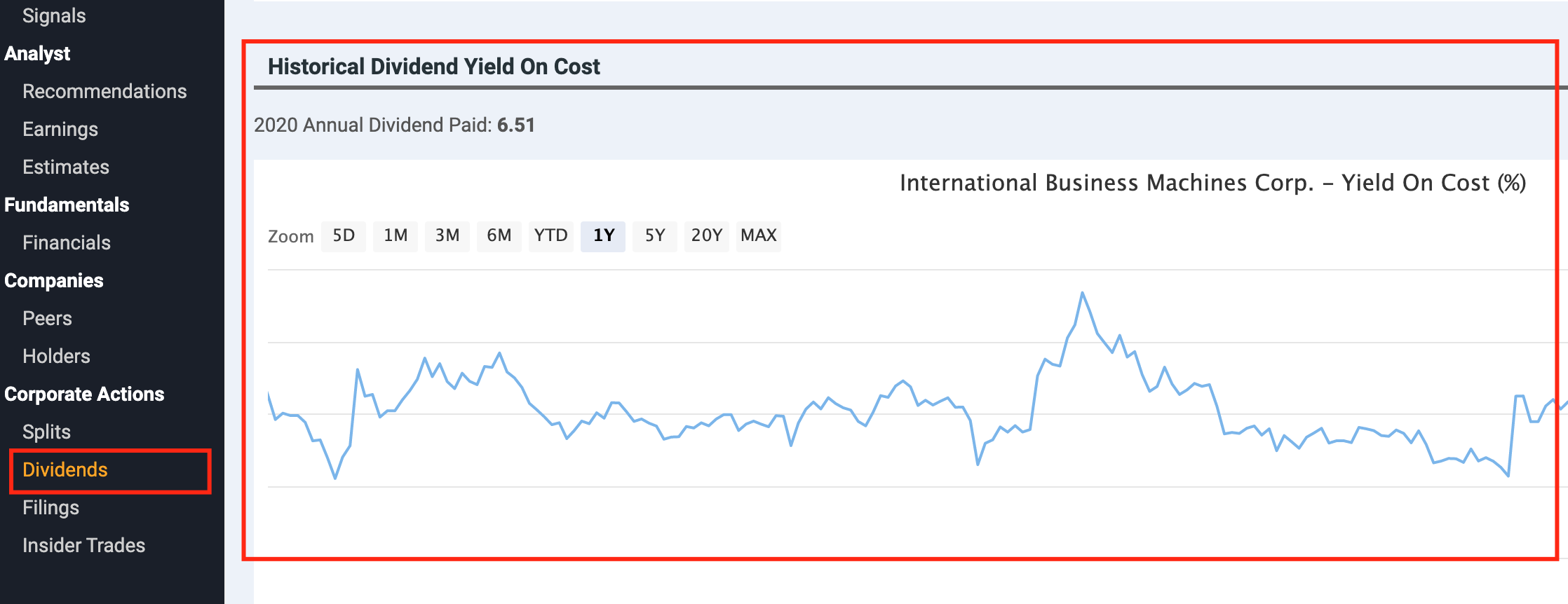

Now you can view any global companies historical dividend yield information via our new app called Dividend Yield.

Historical Dividend Yield

Historical Yield On Cost

How can it be used?

Historical evidence suggests that a focus on dividends may amplify returns rather than slow them down

Is a high dividend yield good?

Yield-oriented investors will generally look for companies that offer high dividend yields, but it is important to dig deeper in order to understand the circumstances leading to the high yield. One approach taken by investors is to focus on companies that have a long track-record of maintaining or raising their dividends, while also verifying that those companies have the underlying financial strength to continue paying dividends well into the future.

To access: Search for a company say IBM, then from the left symbol menu, select Dividends > Dividend Yield